Fossil-Funded Affiliate Programs Renege on Transparency Promise

Dear Coalition Supporters,

Welcome to the new year! We are planning for an active winter quarter, continuing to push the Doerr School of “Sustainability” to live up to its name.

Late last quarter, in response to pressure from us, the affiliate programs finally publicly released funding totals along with a promise that “We will update this website to include individual corporate contributions and the titles of all the projects that these affiliates fund before the end of fall quarter” (see archived webpage here). Transparency is insufficient, as we have long argued, but it is a step in the right direction.

However, the end of fall quarter came and went with no further release of data, and the above sentence promising this data has since been deleted from the website (see current webpage here).

We’d like to give the affiliate program directors the benefit of the doubt — we’re all overwhelmed these days and getting these data together may take time — but this is harder to do since they no longer profess the intention of releasing more data. If there is nothing to hide, why not open the books?

We will keep pushing to get more transparency and, ultimately, dissociation from fossil fuel companies. Let’s turn the Doerr School from a foot-dragging embarrassment mocked by cleantech enthusiasts and big-name directors into a forward-thinking sustainability institution pushing others to follow its lead. Stay tuned.

Major Win on Transparency: Affiliate Funding Details Released

Since the launch of the Doerr School last year, we have been advocating for dissociation from fossil fuel companies. A first step in this process is transparency about how much fossil fuel money is flowing into the school and what it is funding.

Several days ago, the first set of funding data was publicly released! More will be released shortly. These data were gathered by the Committee on Funding of Energy Research and Education (CFERE), established last December under pressure from us. While these data cover only affiliate programs, excluding gifts and sponsored research, this is nonetheless a major step forward in transparency.

What do these new data show? In 2022, the total Doerr School affiliate funding amounted to just under $10 million, with the most funding going to the Natural Gas Initiative (covered previously). In a recent fireside chat at Stanford, alongside actress Jane Fonda and billionaire investor Tom Steyer, climate activist Bill McKibben specifically called out the Stanford Natural Gas Initiative for ‘“greenwashing” the world’s “most dangerous” industry,’” as reported by the Stanford Daily.

As we have outlined in past newsletters, oil and gas companies get to brand their propaganda with the Stanford name, use Stanford’s name in public-facing statements, get a preferential recruitment pipeline, shape the research agenda, and get their representatives invited to teach undergraduates — all for $10 million per year.

Let’s put $10 million per year in perspective. This is 0.018% of ExxonMobil’s profits in 2022. It is just a bit more than the cost of a 30-second SuperBowl ad. It is 12% of the Doerr School’s founding endowment’s expected annual returns, assuming 5% annual growth. It is 0.8% of Stanford University’s annual payout in the 2019-2020 fiscal year.

What does this tell us? Oil and gas companies are meddling in Stanford’s research, dragging grad students into a dying industry, and purchasing Stanford’s prestige, all for the price of a high-value advertisement.

If the Doerr School administration were actually serious about creating a true school of sustainability, a school that did things in a meaningfully different way from the past, they have more than enough money to create a phaseout fund replacing all of the fossil funding coming into Doerr School affiliate programs.

Decoding CCS: Oil Companies' Role and the Climate Crisis

On Nov. 3rd, we co-hosted Prof. Charles Harvey with Scientists Speak Up for a talk on Carbon Capture and Storage (CCS).

We did not fully record the talk. However, Harvey gave a similar talk at Cornell University, which is available here.

Note: the talk coincided with the department of Energy Science Engineering’s alumni talk. Last year, they hosted a professor of petroleum engineering (and we hosted world-renowned science historian Naomi Oreskes). This year, they doubled down and hosted a lawyer who represented Shell in Nigeria from 2005 - 2008 (she later worked for ExxonMobil). For context, Shell Nigeria has been in court since the 90s for various abuses including complicity in murder, rape, and torture, the arbitrary executions of environmental activists, a corrupt deal that cost the Nigerian gov’t over $1 billion, and countless devastating oil spills.

Some more information about Charles Harvey’s talk:

Oil companies are ramping up their advocacy for carbon capture and sequestration (CCS). On the surface, they appear committed to addressing the pressing climate crisis, emphasizing the need to employ "every tool in the tool chest" to curtail greenhouse gas emissions. However, is this the full story?

Our speaker, Stanford alumnus and MIT Professor Charles Harvey, delves into three key reasons that challenge the proactive stance of these companies on CCS:

Opportunity Costs: Allocating resources to CCS could divert critical funding and focus from more impactful emission reduction methods, particularly the adoption of renewable energy.

CCS's Role in Producing More Oil and Gas: It's revealed that most carbon dioxide used in CCS processes is for enhanced oil recovery and much of it was geologic CO2 co-produced with natural gas. Furthermore, subsidies given to CCS inadvertently support oil and, separately, gas production, highlighting a contradictory agenda.

Augmenting the Market for Fossil Fuels: CCS operations consume vast amounts of energy, inadvertently expanding the demand for fossil fuels. There's also a concern that subsidies dedicated to CCS could deter the growth of innovative technologies that bypass the need for burning fossil fuels altogether.

In addition to these central points, Dr. Harvey sheds light on a concerning trend: the influence of oil companies on academic research. Notable institutions, including MIT and Stanford, have seen their researchers funded by oil giants to produce studies in favor of CCS.

How oil and gas companies’ perspectives get Stanford branding, a CCS case study

Today we are sharing a case study of how one Stanford Doerr School affiliate program launders the fossil fuel industry’s perspective and presents it as credible, Stanford-branded analysis. We also share one of the few non-oil-funded analyses of CCS as well as some no-BS insight from the climate and sustainability organization RMI.

Summary

1) The Stanford Center for Carbon Storage, part of the Doerr School of “Sustainability” is funded by fossil fuel companies and directed by a recently-former Chevron executive and four faculty with bilateral research contracts with oil and gas companies.

2) The Center produces reports funded by and largely or partially overseen by fossil fuel representatives and leaders of “astroturf” groups, but that nonetheless carry Stanford branding.

3) These reports often contain language virtually indistinguishable from their funders pro-fossil propaganda.

4) MIT Prof. Charles Harvey, the former CEO of a CCS company, unpacks the accounting sleight of hand underlying CCS claims. He also discusses how oil money and influence keeps interest in CCS alive at universities (like Stanford).

5) We share some straight-talking from sustainability organization RMI on the accuracy oil-funded analyses and forecasts.

Details and Receipts

Directed by a former oil exec

The Stanford Center for Carbon Storage is mostly funded by oil and gas companies. These include Saudi Aramco, ExxonMobil, Chevron, and Occidental. Its Managing Director, Sarah Saltzer, worked for over a two decades in oil and gas, including as an in-house consultant and executive for Chevron until 2016. The other four directors have all signed direct research contracts with oil and gas companies in the last several years to research ways of boosting fossil fuel production including optimizing oil field production, improved hydraulic fracturing, and developing Saudi Arabia’s shale gas fields in 2017.

Reports funded and overseen by fossil fuel interests

Like the Natural Gas Initiative, which we have discussed previously, the SCCS publishes industry-funded reports. The reports skip the critical scrutiny provided by peer review but nonetheless carry the prestige of Stanford branding.

The SCCS has published several reports, each of which could serve as an illustrative example. We will look at one today as an example.

This report was the output of a workshop held by the SCCS in 2021. The reportand associated workshop, titled “Pathways to Carbon Neutrality in California: Clean Energy Solutions that Work for Everyone,” were funded by a who’s who of climate-obstructive trade associations, including the Western States Petroleum Association, the California Cattlemen’s Association, the California Chamber of Commerce, and the California Building Industry Association. Sponsors also include organizations representing humorously specific special interests like the International Brotherhood of Boilermakers (boilermakers make boilers, which burn fossil fuels).

The SCCS sponsors and this report’s specific sponsors are not hands-off benefactors. Workshop speakers included a VP from Chevron, a VP from the International Brotherhood of Boilermakers, a current and a former CEO of the California Building Industry Association, the President of the Western States Petroleum Association, a policy advocate from the California Chamber of Commerce, and a VP from the Cattlemen’s Association. In addition, there were members of fossil fuel astroturf groups, although these connections were not made clear anywhere on the report or the SCCS website and required further investigation to uncover. For instance, the workshop included Robert Lapsley, CEO of Californians for Affordable and Reliable Energy (CARE), a fossil fuel front group funded by the Western States Petroleum Association that falsely bills itself as grassroots and that engages in anti-climate lobbying in California. Of the workshop’s 25 speakers, 10 were reps from its corporate sponsors and another 7 either represented other corporations or trade associations or have made careers consulting for them. There were 4 representatives from public utilities or community power orgs, 1 rep from a nonprofit, and three academics. Probably needless to say at this point, but there were no environmental justice scholars activists or community organizers.

Reflecting industry propaganda

The report this workshop produced includes many sections that are indistinguishable from the propaganda peddled by its sponsors. Crucially, though, this industry propaganda carries Stanford branding and the names of Stanford professors and students and is thus more credible. A couple of illustrative quotes follow — there are many others:

1) From the SCCS report:

California’s strategy of ‘electrifying everything’ entails at least a doubling of electricity usage, with pretty much everything… running on electricity. This represents a massive bet on electrical reliability and resiliency…

Is an integrated system that has multiple energy sources more resilient than a system that is purely electrical, or purely renewables? [Bolding original]

Compare the above with a statement by one of the report’s funders, the Western States Petroleum Association:

The world’s energy mix is growing and diversifying, but as transportation fuels evolve, we need to ensure that cars can still run, factories can still operate and homes and businesses have the energy they rely on every day. Therefore, fossil fuels will continue to play a significant role in the world’s energy mix well into the future.

…Policymakers should maintain optionality in designing programs and should avoid picking winners and losers while maintaining a focus on reliably delivering energy on a low-carbon future.

The takeaway from both of these passages: don’t be overzealous with electrification. Go slow, be reasonable; there is no one clear solution.

2) From the SCCS report:

Almost all participants were clear that they want to be part of the solution. Participants shared experiences and frustrations with multiple regulatory bodies imposing burdens, seemingly without regard to the cumulative impact.

The concern… is that industry may leave the state due to the high cost and considerable time needed to meet the regulations.

And from the Western States Petroleum Association:

Market-based approaches… outperform command and control measures from an environmental and economic perspective. If a state is going to pursue climate policy, market-based approaches can help balance the need to achieve greenhouse gas emission targets while reducing the economic impact on families, consumers, and the economy.

The takeaway from both: Climate regulations are cumbersome and confusing… so cumbersome that we might just have to take our business elsewhere. We want to be part of the solution, but on our own terms. Market-based approaches are better.

So what about CCS and CCUS?

Watch MIT Professor, Stanford alumnus, and former CEO of a Carbon Capture and Storage company Prof. Charles Harvey unpack the creative accounting behind the misleading claims of CCS’ largely oil-backed boosters in his recent Cornell University talk.

For those unable to watch the talk, its main takeaways are:

Governmental CCS support subsidizes both oil production and gas production

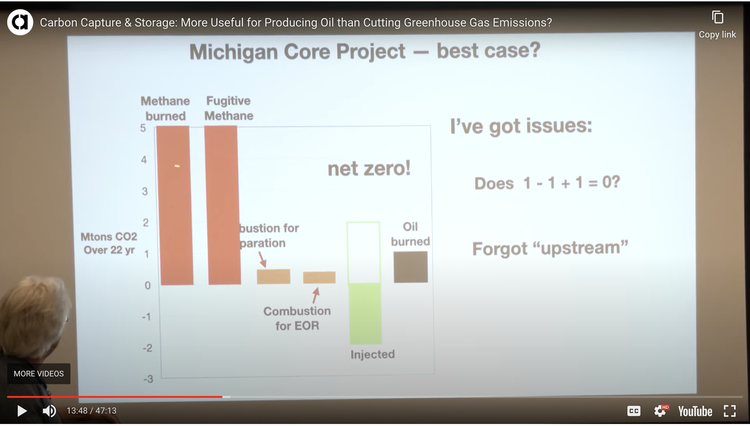

CCS accounting relies on sleight of hand, ignoring gas produced by gas processing plants. At an absolute best, this is equivalent to saying that 1 - 1 + 1 = 0. Most CCS plants are worse.

CCS capacity forecasts have consistently and massively over-estimated growth

Almost all of the academic studies assessing CCS are funded by oil and gas companies, directly or indirectly

Some more context:

CCS captures CO2 from point-sources like a power plants, meaning that CCS requires continued CO2 emissions in order to work. It can’t “clean up our mess” after the fact like other carbon removal strategies.

The “U” in CCUS stands for “utilization” and is almost always a euphemism for enhanced oil recovery — using the CO2 to pump out more oil.

In the vast majority of the world, including in California, renewables are cheaper than gas and coal, and demand-side measures are often cheaper than supply. Thus, shutting down existing gas and coal plants and replacing them with renewables and/or storage and demand-side measures is cheaper than retrofitting them with CCS, which increases operating costs and only pulls a portion (potentially < 30%) of the emitted CO2 from the air.

While renewables have been on an exponential tear, vastly outperforming projections, CCS deployment has been remarkablyslow, well short of projections, despite billions in government subsidies. In 2010, when global CCS installed capacity accounted for~0.04% of global CO2 emissions and global solar power eliminated~0.03% of global CO2 emissions, the International Energy Agency forecast that in 2022 CCS would account for ~2% of global CO2 emissions — a 50-fold increase — and that solar power would eliminate~0.1% of global CO2 emissions — a 3.3 fold increase. The reality? In 2022, CCS installed capacity has only increased by 3-fold from 2010 while total energy produced from solar has surged 40-fold and shows no signs of slowing. The IEA got the forecast backwards.

The common metric used for CCS, “installed capacity,” is the theoretical maximum that a plant could capture and is almost always greater than the amount actually abated.

Everything we’ve said up until now are taking CCS proponents’ claims at face value. CCS’ claims of carbon-neutrality or negativity use accounting that have been debunked by CCS industry veterans.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Insight

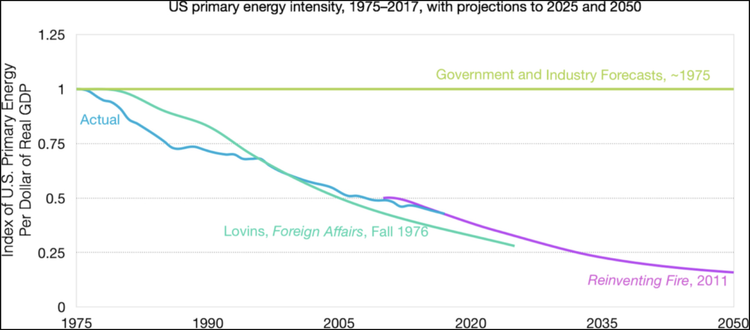

RMI and its founder, Amory Lovins, have a solid track record of predicting energy transitions and what will drive them (for instance, see the comparison figure below).

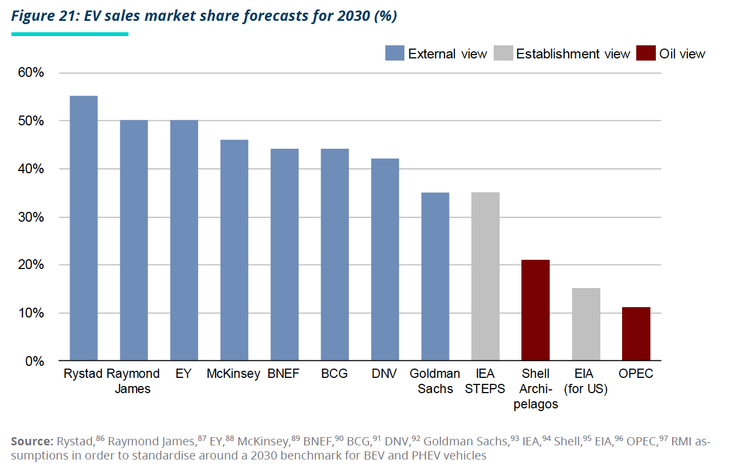

In a recent analysis of the the global transition to EVs, RMI addresses why so many other forecasts (split into three categories) continue to be so far off. Below are selected observations. We encourage those interested to read the entire report.

“The oil view. The desire of the fossil fuel sector for slow change, given form in an Excel spread-sheet. While we can and should largely dismiss these forecasts, they are given far too much credence by many people. It is reasonable to be skeptical about oil sector forecasts for EV sales.

Establishment view. The view of incumbent organisations such as the IEA or the EIA. These forecasts can be dragged down by the inherent conservatism of organisations seeking to pull together the views of oil producers and users.

External expert view. The view of external experts such as BNEF or the investment banks. These are superior, but as we show below they have also been forced to upgrade in light of the facts.

They provide detail on each category. Below is what they have to say about oil company forecasts:

5.2.2 The oil view

Some oil companies profess great theoretical enthusiasm for EV but then provide a long litany of concerns that, regrettably, will hold back growth. They worry about mineral availability, price, the Global South, charging infrastructure, and so on. And by worrying, they manage to persuade themselves that EV will not grow very fast. Which is very reassuring, because their business model is dependent upon their ability to hold back the growth of EV for as long as possible.

Some organisations are deeply linked to their high-paying clients in the oil sector, and we leave to the reader to judge whether those close relationships imperil the ability of these organisations to think objectively about change. [Bolding added]

Comparison of other forecasts of global EV market share in 2030. X-Change: Cars, by Kingsmill Bond, et al., published by RMI, Inc., 2023. We might note that today’s global battery electric vehicle market share (excluding plug-in hybrids) stands at 10%.

This is a good time to remember that our research at Stanford is only as good as our track record and our credibility. As a university, do we really want to risk producing distorted research and having our work dismissed as biased? It’s time to cut fossil fuel ties.

Straightforwardly Pro-Fossil Fuel Affiliate Programs in the Doerr School of “Sustainability”

Sept 27, 2023

As the school year progresses, we will continue our summer-style scoops and add in action items and other updates. We’ve been pleased to see so many new sign-ups for our newsletter and follows on our socials since classes began, and such expressions of support. For new folks, you can read our backlog here and get more of the lay of the land here.

So far this summer, we’ve covered relatively new Doerr School of “Sustainability” affiliate programs that are heavily fossil-funded and that in many ways serve Big Oil’s strategy of distraction and delay, but that nonetheless frame themselves as sustainability-focused and that in many cases include genuinely pro-climate research along with the greenwashing.

For a change of pace, today we are covering the Smart Fields Consortium (SFC), one of the Doerr School of “Sustainability’s” older affiliate programs. These older programs tend to be more straightforwardly focused on helping oil and gas companies explore for, extract, and refine oil and gas. Some have hastily thrown CO2 storage into their homepage descriptions for plausible deniability, but there is little evidence their actual published research has shifted away from helping oil and gas companies produce oil and gas.

There are many more such affiliate programs in the Doerr School beyond the SFC, programs that we will cover in due time. After discussing the SFC, we’ll also discuss the Doerr School’s Petroleum Investments Fund.

The Smart Fields Consortium

The Smart Fields Consortium (SFC) is funded by Chevron, ExxonMobil, Saudi Aramco, and several other oil and gas companies. Until October 2021, the SFC’s research description read:

“Our aim is to develop efficient software tools for the optimization of oil field development and operations. This includes data assimilation, fast simulation, model updating, and optimal control. Techniques being developed by our group are essential for the success of Smart Fields, also known in industry by names such as i-fields, e-fields, Field of the Future, etc. Optimal control can be implemented in existing fields at any stage of their development and in new fields. We have demonstrated that traditional approaches for developing and operating oil and gas fields are rarely optimal. The positional gains of deploying these new technologies are very significant.”

It was then abruptly jargonized to read:

“Computational optimization, history matching (data assimilation), uncertainty quantification, and data interpretation are key technologies for modern reservoir management. The Stanford Smart Fields Consortium (SFC) is a multidisciplinary program that performs state-of-the-art research in these important areas… A key SFC focus area is the development of deep neural network surrogate models to greatly reduce the computation required for these applications.”

The meaning is the same: the SFC helps oil companies extract oil by figuring out how to do their computations more efficiently. This second description remained until January 2023 — shortly after Stanford’s former president appointed a committee to investigate fossil fuel influence on campus. Remember, this was the SFC’s stated goal as late as 2023, in a school of sustainability.

After January 2023, and through to today, the description reads:

“Computational optimization, history matching (data assimilation), uncertainty quantification, and data interpretation are important technologies for modern reservoir management and carbon storage operations. The Stanford Smart Fields Consortium is a multidisciplinary program that performs state-of-the-art research in these important areas… A key SFC focus is the extension and application of computational methodologies developed for oil/gas production to carbon storage (and eventually hydrogen storage) operations. Several of our projects involve the development of deep-neural-network surrogate models to greatly reduce the computation required for Smart Fields applications.” [Bolding of changed wording added]

We hope this change in language represents a real transition in research. It can take a long time to change a research program, so we don’t yet know, but recent publications do not bode well. One of the program’s most recent publications, from this year, reports a more computationally efficient method of optimizing production from oil and gas wells. The only gesture to anything else is a line in the conclusion, “Application of the framework to other recovery processes and CO2 storage operations should also be investigated.”

Remember, this is 2023. Even if the change in language of the description did represent a real change in research, it is too little, too late, and carbon storage itself is considered by many — including those formerly in the oil and gas industry — to be a greenwashing scheme.

This example points to another problem with fossil funding, beyond the many we have already covered. The above paper acknowledges use of Stanford’s Center for Computational Earth and Environmental Sciences as well as funding from both the Stanford Graduate Fellowship and from the SFC’s affiliate companies. The existence of the fossil-funded SFC is pulling non-fossil resources along with it, resources that could be employed on something other than helping oil and gas companies produce oil and gas.

The Doerr School Petroleum Investments Fund

To the best of our knowledge, the Stanford Doerr School of “Sustainability” has a fund that specifically invests in producing oil and gas fields. It yields discretionary funds for the dean, Arun Majumdar.

This conclusion is based on a 2014 document, which states the following:

“Established in 1953, the PIF is an endowment that invests in producing oil and gas royalties and other mineral and energy interests to provide discretionary income for use by the dean to support the teaching and research of the School of Earth Sciences—$1.628 million for the 2013 fiscal year. The principal value of the PIF has grown from about $4 million in 1996 to its current $48 million.”

We have not been able to find any publicly-available evidence that the fund has been retired and thus have reason to assume it has been folded into the new Stanford Doerr School along with the rest of the School of Earth. Our organization is primarily concerned with fossil fuel companies funding research (not issues of endowment or investments). However, if this fund still exists, it sufficiently concerning in a school of “sustainability” that we thought it ought to be highlighted.

Back-to-School Special: Critical Thinking Toolkit (Part II)

Sent on Friday, Sept 8, 2023

We hope you enjoyed our first installment of our “Critical Thinking Toolkit.”

Today we are sharing six peer-reviewed academic papers that provide a background to the issue of industry funding of academic research in general, and of fossil fuel funding of climate and sustainability research in particular. We hope you will read at least our summary of them, if not the entire papers. We highlighted three of these papers to prioritize as “must reads.”

Essential Background to Understanding Fossil Fuel Influence and Oily Thinking

First is a review that assesses how industry funding shapes the overall research agenda (as opposed to the outcomes of individual studies). This study is not specifically focused on fossil fuel influence, but, as reported by investigative journalists such as Amy Westervelt, Dharna Noor, and Oliver Milman, as well as academics such as Ben Franta, Geoffrey Supran, Naomi Oreskes, Jennifer Jacquet, today’s fossil fuel industry is using the same or similar tactics as those described by this review.

The influence of industry sponsorship on the research agenda: A scoping review. Fabbri, A., Lai, A., Grundy, Q. & Bero, L. A. Am J Public Health 108, e9–e6 (2018). [Must read]

Takeaway: “Our findings suggest that corporate funding of research with commercial implications drives the research agenda away from public health priorities.”

Prioritize marketability: Industry tended to prioritize lines of inquiry that focus on products, processes, or activities that can be commercialized and marketed

Prioritize high-income markets: In medical fields, this often meant prioritizing products and high-income markets over behavioral or policy changes and low-income markets

Prioritize industry-desired policy implications: One industry strategy found was to “establish priority research agendas that were favorable to industry’s legal and policy positions.” For example, “‘The ultimate aim of the [Sugar Research] Foundation in dental research has been to discover effective means of controlling tooth decay by methods other than restricting carbohydrate intake.’”

Fund research the industry wants. A second strategy found was to “strategically fund research along priority research agendas in a way that appeared scientifically credible.” For instance, despite making claims to the contrary, the tobacco industry preferentially funded studies recommended by industry executives and lawyers and were “goal oriented.”

Invite scientists to industry-sponsored events to gain credibility. A third strategy found was to “disseminate the industry’s research agenda by enrolling non-industry stakeholders through conferences, committees, and other joint initiatives.” For instance, Phillip Morris initiated a conference attended by all 6 major tobacco companies as well as prominent publicly- and industry-funded behavioral and social scientists, “lending scientific stature and credibility to the conference.”

Next is a historical investigation of how fossil fuel companies co-opted economists, representing a detailed example of the patterns described by the review above. Much of this should sound familiar, given the Stanford Natural Gas and Hydrogen Initiatives’ industry-funded and industry-slanted publications (for details, see here).

Franta, B. Weaponizing economics: Big Oil, economic consultants, and climate policy delay. Env Polit 31, 555–575 (2021).

Takeaway: From the 1990s - 2010s (at least), economists were funded by the petroleum industry to estimate costs of climate policies. Their models inflated predicted costs while ignoring policy benefits, and their results were often portrayed to the public as independent rather than industry-sponsored.

But what about today, and what about Stanford? A recent paper published in Nature Climate Change analyzed how favorable research centers are to natural gas as a function of fossil funding (remember: “natural” gas is a potent greenhouse gas and fossil fuel).

Almond, D., Du, X. & Papp, A. Favourability towards natural gas relates to funding source of university energy centres. Nature Climate Change 2022 12:12 12, 1122–1128 (2022). [Must read]

Takeaway: “We found that fossil-funded centres are more favourable in their reports towards natural gas than towards renewable energy, and tweets are more favourable when they mention funders by name. Centres less dependent on fossil funding show a reversed pattern with more neutral sentiment towards gas, and favour solar and hydro power.”

Positive toward gas: Energy centers heavily funded by the fossil industry write reports that are on average positive towards natural gas.

More positive towards gas than renewables: The Stanford’s Natural Gas Initiative, MIT’s Energy Institute, and Columbia’s Center on Global Energy Policy together are more positive towards natural gas than towards renewables, including solar and hydro.

Like gas trade associations: The magnitude of this positive sentiment is indistinguishable from that of the trade groups the American Gas Foundation and the American Gas Association

@StanfordEnergy is the worst: @StanfordEnergy has the starkest overall pro-funder sentiment of all analyzed and is the most negative to non-funders

Significant funder input: Funders are given significant input into the research agenda at the Stanford Natural Gas Initiative and other fossil-funded centers.

Author effect: Authors affiliated with natural gas-using/promoting companies are especially positive in how they write about natural gas in energy center reports, but overall center sentiment is not accounted nor confined to this author effect.

How does pro-fossil climate delay logic play out? Lamb et al. lay it out in a systematic, digestible way. Their graphic on “discourses of climate delay” (Figure 1, reproduced below) is invaluable for any students getting lectured by professors infected with oily thinking.

Lamb, W. F. et al. Discourses of climate delay. Global Sustainability 3, e17 (2020). [Must read]

Takeaway: Discourses of climate delay can be grouped into four categories: redirect responsibility, surrender, emphasize downsides of change, push non-transformative solutions.

Which of these have you noticed at Stanford?

This next paper quantifies the amount of oil, gas, and coal reserves that must be left in the ground in order to avoid 1.5C and 2C of warming. Why is this important? Since the study finds we must leave most known reserves in the ground in order to stay below 1.5C (and even 2C) of warming, any company exploring for new reserves is violating the Paris Agreement. To our knowledge, assessing each of Stanford’s fossil funders individually, all are exploring for new reserves.

Welsby, D., Price, J., Pye, S. & Ekins, P. Unextractable fossil fuels in a 1.5 °C world. Nature 2021 597:7875 597, 230–234 (2021).

Takeaway: “By 2050, we find that nearly 60 per cent of oil and fossil methane gas, and 90 per cent of coal must remain unextracted to keep within a 1.5 °C carbon budget. This implies that most regions must reach peak production now or during the next decade, rendering many operational and planned fossil fuel projects unviable.”

Judging by advertising and the occasional headline, oil and gas companies are making major strides towards a renewable world. How do their actual plans stack up with their PR? This study quantitatively evaluates this question for 142 fossil fuel companies.

Rekker, S. et al. Evaluating fossil fuel companies’ alignment with 1.5 °C climate pathways. Nature Climate Change 2023 1–8 (2023) doi:10.1038/s41558-023-01734-0.

Takeaway: “Between 2014 and 2020, 64%, 63% and 70% of coal, oil and gas companies, respectively, produced more than their production budgets under the IPCC’s middle-of-the-road (SSP2-1.9) Paris Agreement-compliant scenario. In addition, if the 142 companies we examined continued their average growth rate trends from 2010 to 2018, they would produce up to 68%, 42% and 53% more than their cumulative production budgets for coal, oil and gas, respectively, by 2050. By providing such simple metrics, based on publicly available data, our method offers stakeholders a way of easily tracking and comparing the performance of different fossil fuel producers against climate goals.”

We hope these resources will be helpful in the new academic year.

Back-to-School Special: Critical Thinking Toolkit (Part I)

Aug 31st, 2023

It’s that time of year again!

If you are a student, happy registration!

As we enter the new academic year, we encourage you to talk with peers, mentors, and students about fossil funding. If this was forwarded to you, you can sign up for our twice-a-month newsletters here. You can access an archive of our past newsletters here.

To students: remember, your professors do not know everything. They are trying their best, but they are human and they have their blind spots.

It can be scary and uncomfortable to challenge a mentor or teacher. We hope to make this task slightly easier by giving you some tools. To that end, we are sharing common “oily perspectives” common at Stanford and sharing and debunking the most common pro-fossil-funding talking points we have heard, so you are prepared to have respectful, challenging, and potentially transformative conversations with peers and mentors.

As you prepare for the schoolyear, know how to identify oily thinking in yourself and others!

Because of successful efforts by oil and gas companies, many of us at Stanford have come to view climate and sustainability at least partially from the perspective of oil and gas companies. We call this “oily thinking.”

Common Manifestations of Oily Thinking

1) Believing that our energy system is dependent on fossil fuels

Example from Natural Gas Initiative Report: “Nigeria and Ghana have both seen gas demand growth fall short of projections, and both are working to diversify their end uses of gas. A common pitfall in gas development is overreliance on the power sector as a source of demand.” Seeing lower-than-expected demand for gas as a “pitfall” is a sign of oily thinking.

2) Framing problems in narrow terms assuming the energy system will remain mostly unchanged. Framing regulations as passive forces to which one must adapt.

Example from intro to Stanford-led, peer-reviewed paper partially funded by BASF, which earned a “D” grade from InfluenceMap due to its anti-climate lobbying, and by Saudi Aramco: “The adverse effects of incomplete hydrocarbon combustion and tighter environmental regulations dictate the need for more efficient combustion catalysts in automobile exhausts.” Oily thinking assumes it is all about fossil fuels and frames reducing emissions as necessary because of regulation, not because it saves lives. A clean energy perspective would be, for example, "The adverse effects of incomplete hydrocarbon combustion, which include millions of premature deaths due to air pollution, dictate the need to rapidly phase out fossil fuels in automobiles."

3) Being unaware of or dismissive of current trends in renewables deployment and prices, electrification, and changes in mobility patterns.

Example: “You see a lot of Teslas around here, sure, but what about the rest of the world? For things to scale, they must be applicable beyond the wealthy Silicon Valley bubble. Be reasonable.” A good follow-up question if this sign is encountered: “What was the global-average battery-electric and plugin hybrid vehicle marketshare in June 2023? (Answer: 19%)” “What was it in 2020? (Answer: 5%)”

4) Framing emissions reductions in terms of sacrifice, especially when it comes to the Global South. Gesturing at "rationality” and “moderation.”

Example from an episode of the Shell-sponsored podcast “The Rational Middle,” which also featured Doerr School Dean Arun Majumdar: “The challenge globally right now is how do we balance this need for development and higher incomes and higher energy use with a greener world?” Some good follow-ups if this sign is encountered:

“Name the countries in which renewables are not cheaper than fossil fuels, excluding subsidies for renewables and including subsidies for fossil fuels (Answer, according to Bloomberg NEF: S Korea, Indonesia, Russia, Ghana, Togo)”

“What percentage of Vietnam’s electricity comes from distributed solar today? (Answer: 11%). And in 2018? (Answer: Essentially zero)”

Are you ready to talk about fossil fuel funding with peers and mentors? Here are common pro-fossil-funding arguments you may hear:

You may hear:

“We need the vast resources of fossil fuel companies to match the magnitude of the climate problem.”

The facts: We don’t need them.

The energy transition would be aided by true collaboration with fossil fuel companies. However, these companies have lied about climate science and about their sustainability ambitions and fought climate progress at every turn.

We can rapidly decarbonize without their help (for instance, 8 of the 10 largest renewable energy companies in the world have no connection to fossil fuels). Fossil fuel companies can help by backing pro-climate legislation and investing in renewables.

You may hear:

“It is wrong to paint the entire fossil fuel industry with a single brush. For instance, BP just invested in electrical vehicle charging infrastructure.”

The facts: None of them are anywhere near the right track.

As fossil fuel companies reap trillions in profits from fossil fuels, they invest a tiny fraction of this money into renewable energy and electrification. This buys them positive publicity.

You may hear:

“Fossil fuels are currently necessary for society, but tobacco is not. Thus arguments making parallels with tobacco funding of public health research do not apply. [Argument also made regarding coal vs. oil & gas].”

The facts: They are sowing disinformation, like the tobacco companies.

The tobacco industry sowed doubt and confusion about the link between cancer and smoking by funding academic research, successfully delaying regulation. Fossil fuel companies are copying their playbook. The techniques are the same, even though the products are different.

You may hear:

“I take fossil fuel money to do climate research. My work has never been impacted by my funders. I’ve always pushed back on them if they questioned my results. How dare you suggest I’m being manipulated?”

The facts: They influence research.

Peer-reviewed meta-analyses of many studies have concluded that industry funding influences the outcomes of individual studies and can shift the overall research agenda even if researchers believe they are being objective. For instance, fossil-funded research centers (such as at Stanford) were found to be systematically more favorable to gas than independent centers.

You may hear:

“By partnering with fossil fuel companies, Stanford researchers have a seat at the decision-making table and can help companies change their business models.”

The facts: University partnerships haven’t changed them.

After decades of collaboration with Stanford and other universities, oil and gas companies continue to obstruct climate progress and sink the lion’s share of profits into oil and gas development and stock buybacks.

You may hear:

“We will be using fossil fuels for the foreseeable future, so in the meantime we should research how to use them more cleanly and more efficiently.”

The facts: A fossil-free future is necessary and almost fully possible with today’s technology.

To avoid the most catastrophic effects of climate change, we must rapidly cut greenhouse gas emissions, at least in half by 2030 and to zero in 2050. We have the technology to do almost all of this today.

The Stanford Doerr School of Climate Delay Welcomes a New Fossil Fuel Funder!

(Originally sent on Aug 25th, 2023)

SoCalGas recently became the Stanford Hydrogen Initiative’s newest sponsor. SoCalGas is a gas utility serving Southern California. It controls the now-infamous Aliso Canyon gas storage field, which leaked over 100,000 tons of methane in 2015. SoCalGas’s parent company, SempraEnergy, is the 5th most climate-obstructive company in the world, according to InfluenceMap, an organization that tracks climate lobbying.

Besides stepping in to sponsor research at the Doerr School, What has SoCalGas been up to lately? Here is an partial rundown, from InfluenceMap (original documents linked on their page) and other sources:

SoCalGas opposed a 2019 bill aiming to reduce carbon emissions throughout California (AB 3232)

SoCalGas helped to set up the Californians for Balanced Energy Solutions (C4Bes), a coalition that fights building electrification throughout California, in 2019

SoCalGas opposed California’s proposed all-electric baseline, in Title 24 (California’s building energy efficiency regulation) in August 2020 comments to the California Energy Commission

SoCalGas argued that natural gas is vital for building decarbonization in comments submitted to the California Energy Commission, Dec. 2020

SoCalGas advocated to exempt compressed natural gas (CNG) vehicles from mandatory compliance under California's Low Carbon Fuel Standard program in comments to CARB, in August 2020

SoCalGas submitted comments throughout 2019 and 2020 to expand the rule’s definition of “near zero” emissions to include gas-powered vehicles.

SoCalGas Backed a Lawsuit Against Berkeley’s Effort to Electrify

Shortly after it became the first city in the country to ban natural gas hookups in new construction, the City of Berkeley was sued by the California Restaurant Association. As reported in the Sacramento Bee, SoCalGas funneled millions to the California Restaurant Association, which in turn supported the utility's campaign against building electrification via litigation and PR campaigns. The effort, was a precursor to this year's manufactured outrage over gas stoves.

SoCalGas Uses Ratepayer Funds to Undermine Climate Policy

As recently reported in the Sacramento Bee, since 2019, SoCalGas funneled at least $36 million dollars of ratepayer funds into political lobbying to undermine climate policy. Ratepayers picked up the tab for astroturf campaigns, litigation attacking building electrification, and much more. An administrative judge for the California Public Utilities commission fined Sempra (SoCalGas’ parent company) $10 million in 2022 for, in the judge’s words, “profound, brazen disrespect for the Commission’s authority” in their continued use of California rate-payer’s funds for illegal lobbying.

Why would SoCalGas join the Hydrogen Initiative at the Doerr School?

SoCalGas has been a longtime member of the Stanford Doerr School’s Natural Gas Initiative. But why the new interest in the hydrogen initiative? For a quantitative and thorough exploration of the fossil fuel industry’s vision of a “hydrogen economy” and of the question “why is the fossil fuel industry so uniformly pro-hydrogen while most scientific bodies and environmental organizations so skeptical?” we direct those interested to the “Hydrogen Economy” slide deck of U VA Prof. John Bean’s NSF-funded project “We Can Figure This Out” (link here).

Tl;dr, for those who don’t want to go through a dense slide deck: most immediately, almost all hydrogen today is made from gas, so increasing hydrogen use in the short term increases demand for gas (good for their business; disaster for the planet).

In the long term, one could imagine all or most hydrogen coming from renewable sources. But even then, pursuing hydrogen for the majority of sectors is not nearly as climate-friendly as pursuing electrification. As always, the gas industry is pursuing hydrogen to preserve its profits, not the climate:

A hydrogen-based economy will still be beholden to a centralized utility. Green hydrogen infrastructure is by necessity large and expensive, meaning significant barriers to entry. While households and communities can put up their own solar/battery installations to reduce their reliance on utility-provided electricity, households will not be building green hydrogen factories in their backyard.

Hydrogen-based energy is slower to develop than electrification and will delay decarbonization for most sectors. Moving energy with electrons is far faster, cheaper, and more efficient than doing so through molecules like hydrogen. Thus, for electrifiable sectors such as mobility and buildings, the switch from fossil fuels to electricity will be faster than a switch from fossil fuels to hydrogen. Pushing for hydrogen serves as a delay tactic.

There is abundant evidence that fully converting certain sectors to hydrogen is impossible or near-impossible. For example, SoCalGas is advocating for blending hydrogen into the natural gas supplied to homes. Because hydrogen embrittles steel at sufficiently high pressures, it isn’t possible to fully replace gas with hydrogen (putting aside that hydrogen is leakier than already-leaky gas, is explosive over a much wider concentration range than gas, and has an indirect global warming potential of over 10 times that of CO2). There is no fossil-free endgame to this strategy, but pursuing hydrogen useful delay tactic, all while we still pay the utility for natural gas.

Using green hydrogen is certainly a climate-friendly way to replace the large quantity of fossil-derived hydrogen used today. Green hydrogen may also find legitimate new uses in steel and cement manufacture, long-duration energy storage, and even long-haul aviation, although start-ups are working on fully-electric steel manufacture and some have argued that superior solutions exist for grid storage and aviation and that the role of hydrogen will be marginal in these sectors (see here, and here for the grid and for aviation, respectively). For almost all other sectors, though, electrification is possible, far more efficient, and is already scaling rapidly. Electrification would mean lower profits for gas utilities and fossil fuel companies, so they are willing to fight for hydrogen if it means slowing electrification.

Stanford’s Connection to SoCalGas/Sempra:

Given SoCalGas and Sempra Energy’s ongoing efforts to stymie climate progress, efforts sometimes crossing the line into illegality, one would hope that professors and administrators at Stanford would keep SoCalGas at arm’s length, even if they take their money. Unfortunately, as we’ve seen repeatedly in past newsletters, Stanford loves getting cozy with its climate-obstructive sponsors.

Here is an partial rundown of the connections between SoCalGas and the Stanford Doerr School of Sustainability and its predecessor, the School of Earth. The Doerr School of Sustainability houses both the Natural Gas Initiative and the Hydrogen Initiative. Though it has pretensions to the contrary, the Natural Gas Initiative is focused on continuing to burn natural gas, fully aligned with the interests of the fossil fuel companies and utilities that sell gas.

In 2019, The Stanford Natural Gas Initiative (NGI), and its relationship with SoCalGas, was written up in a special feature for the American Gas Association’s industry publication, the American Gas Magazine. The publication includes several statements that are factually challenged (from eyebrow-raisers to the laughably absurd) and that fit a narrative convenient to those in the business of selling gas. For instance:

“NGI was set up in 2015 in recognition of how important natural gas was going to become in a decarbonizing world” —Naomi Boness, Managing Director of the NGI and longtime Chevron strategist.

Reality Check: Gas is a fossil fuel, potent greenhouse gas, and leads to more warming than coal per unit energy if >5% leaks, as it often does from upstream production alone.“The benefit of having industry partners is to ensure that the research being conducted at Stanford is aligned with practical issues and problems that need solving out in the real world.” —Naomi Boness.

Reality Check: Having gas industry partners ensures that what the gas industry views as problems will get prioritized and that non-threatening research questions are asked. “How can we minimize gas leakage?” Ok. “How can we rapidly electrify to get rid of gas?” Definitely not.“We believe the billions of dollars invested in natural gas technology have an important role to play in solving climate problems. We don’t see a future where we wouldn’t need gas—it’s a staple, and it’s renewable.” –– Chris Cavanagh, Principle Program Manager, National Grid (a New York utility).

Reality Check: Gas worsens climate change. Gas is not renewable. There is no such thing as renewable gas.

The Stanford School of Earth invited SoCalGas’s “Director of Sustainability” to discuss its 2045 net zero goal. Their goal stipulates delivering gas to consumers without emitting CO2 in the delivery. This is their laughable definition of “net zero.” They do not include in their calculation the carbon emissions caused by the natural gas they sell and profit from when their customers burn the gas, emitting vast amounts of CO2.

The Stanford Natural Gas Initiative co-hosted an event on “the interplay of hydrogen and natural gas” with Energy Dialogues, LLC, a networking platform for “energy” companies. Among the speakers was Jawaad Malik, VP of Strategy and Sustainability for SoCalGas. Other speakers included the Executive VP of British Petroleum and a VP of PlugPower, a hydrogen fuel cell company, a professor, and a representative from a hydrogen company and a law firm. The scope of the conversation focused on the perspectives of companies selling gas and hydrogen (see linked report) – no green-sector views were represented. This teaches us that the fossil fuel industry, and the Doerr School, use the word “energy companies” to mean “fossil fuel and fossil fuel logistics companies.” Green energies apparently need not be included in “energy dialogues.

The Stanford Natural Gas Initiative hosted panel discussions on “Sector Coupling of the Electric and Gas Systems in North America,” “Natural Gas in a High-Renewables, Decarbonizing World,” and a “Hydrogen Workshop,” all of which which featured SoCalGas’ Senior Director of Business Development, Yuri Freedman. Shoving hydrogen into as many sectors as possible, whether or not it makes any sense, is one of the fossil fuel industry’s latest delay tactics, and Stanford’s Doerr School of Un-Sustainability is enthusiastically embracing it.

Progress in Europe and the East Coast, Denialism at Stanford, Freedom, Integrity, and a Scoop

(Originally sent on August 11, 2023)

This week, we are:

1) sharing some exciting dissociation updates from universities that are ahead of Stanford

2) addressing a comment made by our dean that exemplifies the conveniently muddled thinking practiced by some of our leadership (including the Managing Director of the Natural Gas Initiative; see her here on PBS repeating the American Gas Association’s talking points), and

3) sharing information about Stanford’s StorageX Initiative.

Exciting News from Leaders in Fossil Fuel Dissociation

Since Princeton University announced its rejection of research funding from 90 fossil fuel companies in September of 2022, momentum for dissociation has been building, this summer in particular:

In June, Vrije Universiteit university in Amsterdam announced it will end all research collaborations with all companies that cannot demonstrably commit to the Paris Agreement in the short-term. In practice, this means dissociation from all fossil fuel companies.

In July:

an internal, university-sanctioned report by Cambridge University was published. It concluded that “it is difficult to find the logic behind the decision to continue to accept funding from fossil fuel funding sources.”

the University of Utrecht announced its guiding principle that the “university will only enter into research collaborations with fossil fuel companies and organizations if they are intensively and demonstrably committed to accelerating the energy transition, in line with the Paris Climate Agreement.” Specific criteria will be further concretized after the summer.

the University of Amsterdam announced it will no longer collaborate or accept funding from fossil fuel companies unless a set of strict criteria are met.

The University of Amsterdam set a particularly forward-thinking example by arriving at its decision through a deliberative process (described in detail in the downloadable report here).

They pulled off this entire process in a matter of months, compared to Stanford’s year of red tape and closed-door dialogues.

Addressing our Dean’s Denialism

The Doerr School’s dean, Arun Majumdar, was recently a guest on the Hydrogen Initiative Podcast, a podcast partially funded by Chevron, ExxonMobil, Shell, and other fossil fuel companies. Many of the dean’s comments on the podcast were factually-grounded. He did falsely state that all the IPCC’s pathways include carbon removal (see Grubler et al. 2018, cited here by the IPCC for a clear counterexample; also included are pathways with very low carbon removal), but we can let that slide.

However, he also made a jarring claim, saying:

“At least to my knowledge, I’ve seen all major countries, all major corporations, academia, all aligned towards this goal [of addressing climate change] because people realize it’s a problem.”

This is false and contradicts some of his previous statements. Oil and gas supermajors have actually walked back their climate commitments. Many of these companies recently lobbied to weaken the UK’s Climate Compatibility Checkpoint, to weaken gas leak taxation schemes, to weaken renewable hydrogen standards, and to speed permitting of new oil and gas infrastructure (see here for these and numerous other examples). Indeed, the fossil fuel industry’s hostility to climate action has recently become so blatant that prominent COP and UNFCCC organizers have written mea culpas regarding their past willingness to give the industry a seat at the table (see here and here). The Dean’s false statement of global unity is a tacit endorsement of fossil fuel companies whose representatives publicly lie and lobby against climate action.

As an antidote to the denialism exemplified by our dean’s statement, we are sharing a lucid and impassioned talk recently given by former vice president Al Gore. He lists the “unrelenting opposition of the fossil fuel industry” as the #1 obstacle to swift climate progress. Gore also addresses the fossil fuel industry’s latest delay tactics, which have evolved since the days of climate denial, and which have taken root in Stanford’s fertile soil. Click the link above or the image below.

For a bit more history on the fossil fuel industry’s consistent opposition to climate action, we recommend this seven-minute overview.

We also wanted to highlight one of the dean’s statements with which we wholeheartedly agree:

“At the end of the day we have to honor one of the basic principles of academia, which is academic freedom, which means that professors and students should be allowed to pursue their education and their research in ways that cannot be controlled by other people.”

Of course, there are plenty of ways that professors’ research is already affected by other people (what kind of research can secure funding, what is subject to ethics restrictions, what projects are available for students, and more). But in principle, we could not agree more. This is why we want decisions about our school’s focus to be made by students, staff, and faculty, and not be influenced by fossil fuel representatives; why we want courses untarnished by fossil fuel representatives; why we want professors who reject fossil fuel funding to be highlighted and celebrated for their independence; and why we want students to know where their funding comes from and to have the option of pursuing research that is not funded by and influenced by fossil fuel interests. Jake Lowe and Connor Chung have an excellent piece unpacking how fossil fuel funding undermines academic freedom.

We also recognize that with great prestige and power comes a responsibility for academic integrity. And we know that when its reputation is sufficiently at stake, Stanford’s leadership can be forced to care about academic integrity. In his own words, former Stanford President Tessier-Lavigne resigned because Stanford “needs a president whose leadership is not hampered” by questions of his academic integrity and by discussions of his research. We want all the hard work and scholarship at Stanford to be respected by the world and to be free from the stain of fossil fuels and allegations of conflicts of interest.

This Week’s Scoop: StorageX

Stanford’s StorageX initiative thankfully appears less entangled with fossil fuel interests than other Doerr School affiliate programs: it doesn’t list any former high-level employees at climate-obstructive companies as directors (unlike the Natural Gas Initiative and Hydrogen Initiative — see here) and its reports don’t appear to advocate for policy that directly contradicts the Paris Agreement (unlike the Natural Gas Initiative, see here). Its research largely focuses on batteries and electrification, a crucial part of a rapid energy transition.

In Oct. 2020, a year after its launch, StorageX announced a broadening of focus to include non-electrical storage technologies such as thermal storage and chemical storage. Chemical storage in particular (especially as inefficient and expensive “e-fuels”) is popular among oil and gas companies, but we don’t see evidence that fossil fuel representatives had a direct role in shaping this focus. Shell and ExxonMobil had already been funding this initiative for 10 and 7 months, respectively, once this announcement was made.

This is good news, right? Yes, this is good!

And yet, even in this relatively “clean” affiliate program, fossil fuel money still wields undue influence. At present, StorageX counts Chevron (the world’s most climate-obstructive company according to InfluenceMap), ExxonMobil, Shell, and ConocoPhillips among its funders. This funding comes with all the typical strings attached: seats on the advisory council, invitations to StorageX courses, facilitated student engagement and recruitment opportunities, and more. It also includes intellectual property benefits negotiated as part of sponsored research projects, a benefit absent from other affiliate programs. We were unable to find a public list of these sponsored research programs.

But is all this so bad if students are (largely) working on genuine climate solutions? As we have argued before, fossil funding does damage in several ways even if it is (at least partially) funding pro-climate research.

First, working with companies which oppose climate progress and science itself compromises trust in Stanford’s research. Concerns about academic integrity were raised back in 2007, five years after ExxonMobil donated $100 million to launch the Stanford Global Climate and Energy Project (which allowed companies a say in research proposal selection, granted them final veto power, and gave companies exclusive 5-year rights to any discoveries). More recently, the University of Massachusetts is being investigated after the Boston Globe reported on an industry-influenced study touting hydrogen a substitute for natural gas in residential distribution.

Second, fossil fuel companies are using Stanford’s name to purchase social license as they walk back climate commitments in the name of short-term profit and invest at most single-digit percentages of their operating budgets in renewables. University partnerships and/or Stanford’s name in particular have been touted in the advertising or public-facing websites of ExxonMobil (and here, touting GCEP), Chevron, BP, Saudi Aramco (for more on Stanford’s close relationship with Saudi Arabia and its national oil company, see here), and several more.

Third, Stanford is letting fossil fuel companies recruit its talented graduates into damaging and dead-end careers in the oil and gas industry. For instance, after Chevron became a StorageX sponsor in Spring 2021, paid Chevron internships were offered through StorageX researching carbon capture utilization and storage, the “hydrogen value chain,” “circular plastics,” and other low carbon technologies. These summer opportunities serve both as a recruitment pathway for Chevron and push students towards industry-preferred “solutions.” Some of these “solutions,” like CCS, haven’t seen improvement despite over 50 years of development (see here for a full, peer-reviewed analysis from Oxford) yet offer a license to continue polluting.

We were pleased that StorageX seems less affected by fossil fuel influence than other Stanford affiliate programs, but as our previous Scoops have shown, the bar is very low. We can do better, and with a new president and a renewed focus on academic integrity and on Stanford’s reputation, we believe we will.

Have you heard of the Doerr School’s first new affiliate program? Why not?

Originally sent on July 28, 2023

The Doerr School crossed an important milestone this summer: it got its first new Industrial Affiliate Program as a new school! And it started with a splash: a symposium featuring well-known scholars, activists, and corporate executives, and attended by over 200 (during the summer at a university).

You’d be forgiven for missing the hubbub, however. The Doerr School’s affiliate page doesn’t list the new program and neither the program’s launch nor symposium were reported in the Doerr School’s weekly roundups. The school’s monthly “Inside Doerr School,” Stanford’s “Energy News” newsletter, and Stanford’s “Explore Energy” newsletters omitted it. And the program’s homepage is unindexed on the Doerr School’s website (just try searching for it).

One example to contrast with this silence: The newsletter campaign associated with the Stanford Energy newsletter sent two emails on each of two days of the Doerr School’s StorageX summer symposium. These emails featured no information about other events, only info and a registration link for Storage-X’s symposium.

What’s going on?

The Doerr School’s newest affiliate program, Mineral-X, stands out from its peers. At present, it is the only Doerr School affiliate program to explicitly reject funding from fossil fuel companies. Its founder, Prof. Jef Caers, made this commitment publicly in a talk hosted by the Coalition and in a piece for Nature Geosciences. This isn’t only a matter of principle: to our knowledge, Mineral-X is currently the only Doerr School affiliate program that does not actively accept money from fossil fuel companies.

Mineral-X is also noticeably more focused on environmental justice than its peer programs. For instance, one can contrast Mineral-X’s plans to build in social impact assessments to its research in the early stages, even before minerals are found, with Stanford’s new battery center’s exclusive focus on technological innovation or Storage-X’s exclusively technological and commercial mission statement.

We wanted to share this exciting news, since clearly the Doerr School administration did not.

And by the way, have you ever wanted to learn more about Stanford’s other, much more highly-publicized initiative that ends in “X?” Stay tuned for our next installment.

Exxon goes mask-off (click image to watch advertisement)

Falsifiability is a precondition for a hypothesis or theory to be scientific. At Stanford, the notion that fossil fuel companies can and will be partners in the energy transition, if only they are given a “seat at the table,” has been unfortunately impervious to contradictory evidence for decades. Indeed, even after an ExxonMobil strategist openly admitted to denying science, funding front groups, and advocating for a carbon tax solely because the company believed such a tax would never pass, Stanford hosted ExxonMobil’s CEO, Darren Woods, at its bi-annual “Global Energy Forum” (alongside several other fossil fuel executives and Senator Joe Manchin). Many Stanford faculty who presumably care about climate change attended and spoke, thus legitimizing Woods’ disinformation campaign.

Hope that further evidence of fossil fuel companies’ true intentions may chip away at the credulity entrenched among many at Stanford may seem naïve — as naïve as believing that fossil fuel companies would fund research that would hasten the world’s transition off their core products.

But some cracks in the dogma may be showing, as we discuss below. So, perhaps naïvely, we’re sharing a recent ExxonMobil advertisement against electric cars (click image above to watch the video; produced by ExxonMobil’s subsidiary Mobil 1). May the cracks widen.

After watching the video, please ask yourself: is this a company who should be funding our research, sending its executives to speak at our events, and recruiting our students? Let’s not be fossil fools.

Are people waking up?

This week, Christiana Figueres, former Executive Secretary of the United Nations Framework Convention on Climate Change (UNFCCC) wrote:

“More than most members of the climate community, I have for years held space for the oil and gas industry to finally wake up and stand up to its critical responsibility in history.

“I have done so because I was convinced the global economy could not be decarbonised without their constructive participation and I was therefore willing to support the transformation of their business model.

“But what the industry is doing with its unprecedented profits over the past 12 months has changed my mind.”

Better late than never, perhaps. Journalist Amy Westervelt shares her thoughts on Figueres’ piece and what accountability should look like for people who have enabled the fossil fuel industry during these critical decades and who are only now waking up.

Hydrogen and Natural Gas Initiative Info

Happy July everybody!

We got some feedback that the “quiz” format isn’t the friendliest to people not already versed in the tentacles of fossil fuel funding in the Doerr School, so we’re switching things up this week. Rather than a quiz, we’ll just share a scoop about different domains of fossil fuel influence at Stanford. We’ll continue with our quote, insight, and laughs sections. We’ll also provide a bit of context to the answers from last letter’s quiz on the Hydrogen Initiative.

Answers and Context on Last Week’s Scoop!

Hydrogen Initiative: answers to last letter’s quiz and some context

As a reminder, the Stanford Hydrogen Initiative counts ExxonMobil, Chevron, Shell, SK, and Toyota among its financial backers.

Question 1) The Hydrogen Initiative’s two-member advisory council consists of:

A: A former chief scientist at Shell and a former executive engineer at Toyota [correct answer]

B: A former chief scientist at ExxonMobil and a former chemist for Chevron

C: A former director of engineering at the U.S. Department of Energy and a former scientist at the EPA

D: A professor emeritus of chemistry and a professor emeritus of mechanical engineering

Shell and Toyota have purchased seats on the Hydrogen Initiative’s advisory council for $250,000 per year. While the Hydrogen Initiative doesn’t elaborate on the power of the advisory council, if it is anything like the governing board of the Natural Gas Initiative, then the Advisory Council helps to establish research priorities and suggest projects for seed funding. Shell invests approx. 1.5% of its capex into renewables (duplicitous accounting notwithstanding), and is pulling back from further investment after record oil and gas profits. Toyota is the only auto manufacturer to make it into InfluenceMap’s top-ten list of most obstructive companies on climate policy. It isn’t a huge leap to imagine the types of research that representatives from these companies will steer the initiative towards: research that entrenches chemical fuels and delays the energy transition. Indeed, some focus areas of the Hydrogen Initiative are already heading this way, and include projects on converting hydrogen into liquid fuels and even methane (a notoriously leaky greenhouse gas).

Question 2) In addition to sponsoring research, the Hydrogen Initiative sponsors a class marketed to undergraduates and graduate students (it also sponsors a podcast). Based on the syllabus on the website, the course has three primary instructors: a professor, the managing director of the Natural Gas Initiative, and the Managing Director of the Corporate Affiliates program. The three guest speakers were representatives from:

A: two different oil supermajors that are currently spreading climate disinformation, and a government energy regulator

B: a company selling hydrogen, an environmental justice organization opposed to blue hydrogen, and an air quality regulator

C: A natural gas utility with a recent history of climate obstructionism, an industry trade group representing ammonia manufacturers, and a company selling hydrogen [correct answer]

One would hope that outside speakers would provide diverse (and potentially critical) perspectives in a class. This course’s instructors (Naomi Boness, managing director of the Natural Gas Initiative, Jimmy Chen, Managing director of the Corporate Affiliates Program, and Xiaolin Zheng, a professor) did not. Instead, they invited outside speakers exclusively representing groups with strong financial interests in seeing hydrogen used as much as possible, whether or not it actually makes sense (SoCal gas — parent company Sempra Energy, the Ammonia Energy Association, and Electric Hydrogen). It would be beneficial to these companies’ bottom-line if an entire “Hydrogen Economy” sprung up — conveniently, the name of the course.

Question 3) The Hydrogen Initiative advertises membership benefits to its corporate sponsors, which include “student engagement.” Which of the following does the Hydrogen Initiative sponsor under the header “education” (formerly “student engagement” in an old version of the website):

A: a “Hydrogen Club” offering networking opportunities [correct answer]

B: internship opportunities [correct answer]

C: a course on the “Hydrogen Economy” [correct answer]

Trick question! All three are correct. One major gift Stanford gives fossil fuel companies in exchange for funding research is the opportunity to engage with students. This helps develop a recruitment pipeline, associate friendly faces with the companies in the minds of students, and get students framing problems and questions in ways favorable to the company. For instance, fossil fuel companies might prefer students ask “how do we retrofit natural gas pipelines to work for hydrogen so we can burn hydrogen in stoves, furnaces, and water heaters?” rather than “how can we most quickly, equitably, cheaply, and with lowest-risk slash emissions from stoves, furnaces, water heaters while providing people with hot meals and showers and comfortable homes?”

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This Week’s Scoop: the Natural Gas Initiative!

Stanford has a Natural Gas Initiative (NGI) dedicated to “generat[ing] the knowledge needed to use natural gas to its greatest social, economic, and environmental benefit.” The initiative sells permanent seats on its governance board, along with other benefits, for $250,000 per year to “sustaining members” (rotating seats are sold at lower prices). At present, the four sustaining members are ConocoPhillips, Shell, ExxonMobil, and GTI Energy. The NGI also partners with the Energy Leadership Institute, an organization founded in 2012 by the Colorado Oil & Gas Association with an aim of training “thought leaders” who would be influential in energy policy.

In addition to publishing peer-reviewed papers, the NGI produces non-peer-reviewed “Briefs,” essentially operating like a think tank. Despite avoiding the accountability of peer-review, these briefs nonetheless carry the weight of the Stanford name. Let us use as an example one recent brief authored by NGI Managing Director Naomi Boness. For context, Boness is a 13-year veteran of upstream strategy at Chevron, the world’s most climate-obstructive company according to InfluenceMap. Boness is also a current member of the Renewable Natural Gas Coalition Advisory Committee (which is funded by fossil fuel companies and which has lobbied to weaken guidance on clean hydrogen production), and was past Chair of the Society of Exploration Geophysicists Oil and Gas Reserves Committee.

The brief’s penultimate paragraph captures the overall message:

“The United States has the natural resources and economic strength to significantly add to the world’s LNG [liquified natural gas] supply, strengthen energy security, replace dirtier fuels and lower global carbon emissions. The problem is that our system for approving infrastructure makes it nearly impossible to develop our resources and bring them to market. Until we fundamentally change our approach, we should expect little progress.”

In other words, the US should increase its gas infrastructure and export it, mostly to developing countries. This narrative, promoted in a non-peer-reviewed paper whose sole author is a longtime fossil fuel strategist, is almost identical to the narrative promoted by fossil-fuel front groups. For instance, take Natural Allies for a Clean Energy Future, a group funded by pipeline and gas companies (including Kinder Morgan, which also funds the Natural Gas Initiative) and by plumbers associations (who would lose work if gas infrastructure were obsolete). Natural Allies says that:

“A major solution to help curb carbon emissions, support American jobs, and provide global energy security is to export U.S. Liquified Natural Gas (LNG). The benefits of transporting affordable natural gas to developing nations and Europe allows new economies abroad to flourish, helps secure current energy grids from potential crisis, and prevents bad foreign actors from withholding needed energy supply to our allies.”

It isn’t just that the pro-gas-expansion narrative promoted by Boness’ brief aligns with that of the gas industry. There isn’t anything intrinsically wrong with agreeing with oil and gas companies. More troublingly, Boness’ narrative is contradicted by perspectives and research papers published in respected scientific journals in which material must survive peer-review. There are many such papers, but here are a few examples:

From a recent perspective in Nature Energy:

“We highlight that natural gas is a fossil fuel with a significantly underestimated climate impact that hinders decarbonization through carbon lock-in and stranded assets. We propose five ways to avoid common shortcomings for countries that are developing strategies for greenhouse gas reduction: manage methane emissions of the entire natural gas value chain, revise assumptions of scenario analyses with new research insights on greenhouse gas emissions related to natural gas, replace the ‘bridge’ narrative with unambiguous decarbonization criteria, avoid additional natural gas lock-ins and methane leakage, and take climate-related risks in energy infrastructure planning seriously.”

From a 2016 paper in Applied Energy, authored by several Stanford scholars:

“Natural gas has been suggested as a “bridge fuel” in the transition from coal to a near-zero emission energy system. However, the expansion of natural gas risks a delay in the introduction of near-zero emission energy systems, possibly offsetting the potential climate benefits of a gas-for-coal substitution… Considering only physical climate system effects, we find that there is potential for delays in deployment of near-zero-emission technologies to offset all climate benefits from replacing coal energy systems with natural gas energy systems, especially if natural gas leakage is high, the natural gas energy system is inefficient, and the climate change metric emphasizes decadal time scale changes.”

From a 2021 paper in Nature:

“…we find that nearly 60 per cent of oil and fossil methane gas, and 90 per cent of coal must remain unextracted to keep within a 1.5 °C carbon budget… This implies that most regions must reach peak production now or during the next decade, rendering many operational and planned fossil fuel projects unviable.” In other words, fossil infrastructure expansion, such as that proposed by Stanford’s Boness and by fossil front groups like Natural Allies, is incompatible with the Paris Agreement.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Quote 1