How oil and gas companies’ perspectives get Stanford branding, a CCS case study

Today we are sharing a case study of how one Stanford Doerr School affiliate program launders the fossil fuel industry’s perspective and presents it as credible, Stanford-branded analysis. We also share one of the few non-oil-funded analyses of CCS as well as some no-BS insight from the climate and sustainability organization RMI.

Summary

1) The Stanford Center for Carbon Storage, part of the Doerr School of “Sustainability” is funded by fossil fuel companies and directed by a recently-former Chevron executive and four faculty with bilateral research contracts with oil and gas companies.

2) The Center produces reports funded by and largely or partially overseen by fossil fuel representatives and leaders of “astroturf” groups, but that nonetheless carry Stanford branding.

3) These reports often contain language virtually indistinguishable from their funders pro-fossil propaganda.

4) MIT Prof. Charles Harvey, the former CEO of a CCS company, unpacks the accounting sleight of hand underlying CCS claims. He also discusses how oil money and influence keeps interest in CCS alive at universities (like Stanford).

5) We share some straight-talking from sustainability organization RMI on the accuracy oil-funded analyses and forecasts.

Details and Receipts

Directed by a former oil exec

The Stanford Center for Carbon Storage is mostly funded by oil and gas companies. These include Saudi Aramco, ExxonMobil, Chevron, and Occidental. Its Managing Director, Sarah Saltzer, worked for over a two decades in oil and gas, including as an in-house consultant and executive for Chevron until 2016. The other four directors have all signed direct research contracts with oil and gas companies in the last several years to research ways of boosting fossil fuel production including optimizing oil field production, improved hydraulic fracturing, and developing Saudi Arabia’s shale gas fields in 2017.

Reports funded and overseen by fossil fuel interests

Like the Natural Gas Initiative, which we have discussed previously, the SCCS publishes industry-funded reports. The reports skip the critical scrutiny provided by peer review but nonetheless carry the prestige of Stanford branding.

The SCCS has published several reports, each of which could serve as an illustrative example. We will look at one today as an example.

This report was the output of a workshop held by the SCCS in 2021. The reportand associated workshop, titled “Pathways to Carbon Neutrality in California: Clean Energy Solutions that Work for Everyone,” were funded by a who’s who of climate-obstructive trade associations, including the Western States Petroleum Association, the California Cattlemen’s Association, the California Chamber of Commerce, and the California Building Industry Association. Sponsors also include organizations representing humorously specific special interests like the International Brotherhood of Boilermakers (boilermakers make boilers, which burn fossil fuels).

The SCCS sponsors and this report’s specific sponsors are not hands-off benefactors. Workshop speakers included a VP from Chevron, a VP from the International Brotherhood of Boilermakers, a current and a former CEO of the California Building Industry Association, the President of the Western States Petroleum Association, a policy advocate from the California Chamber of Commerce, and a VP from the Cattlemen’s Association. In addition, there were members of fossil fuel astroturf groups, although these connections were not made clear anywhere on the report or the SCCS website and required further investigation to uncover. For instance, the workshop included Robert Lapsley, CEO of Californians for Affordable and Reliable Energy (CARE), a fossil fuel front group funded by the Western States Petroleum Association that falsely bills itself as grassroots and that engages in anti-climate lobbying in California. Of the workshop’s 25 speakers, 10 were reps from its corporate sponsors and another 7 either represented other corporations or trade associations or have made careers consulting for them. There were 4 representatives from public utilities or community power orgs, 1 rep from a nonprofit, and three academics. Probably needless to say at this point, but there were no environmental justice scholars activists or community organizers.

Reflecting industry propaganda

The report this workshop produced includes many sections that are indistinguishable from the propaganda peddled by its sponsors. Crucially, though, this industry propaganda carries Stanford branding and the names of Stanford professors and students and is thus more credible. A couple of illustrative quotes follow — there are many others:

1) From the SCCS report:

California’s strategy of ‘electrifying everything’ entails at least a doubling of electricity usage, with pretty much everything… running on electricity. This represents a massive bet on electrical reliability and resiliency…

Is an integrated system that has multiple energy sources more resilient than a system that is purely electrical, or purely renewables? [Bolding original]

Compare the above with a statement by one of the report’s funders, the Western States Petroleum Association:

The world’s energy mix is growing and diversifying, but as transportation fuels evolve, we need to ensure that cars can still run, factories can still operate and homes and businesses have the energy they rely on every day. Therefore, fossil fuels will continue to play a significant role in the world’s energy mix well into the future.

…Policymakers should maintain optionality in designing programs and should avoid picking winners and losers while maintaining a focus on reliably delivering energy on a low-carbon future.

The takeaway from both of these passages: don’t be overzealous with electrification. Go slow, be reasonable; there is no one clear solution.

2) From the SCCS report:

Almost all participants were clear that they want to be part of the solution. Participants shared experiences and frustrations with multiple regulatory bodies imposing burdens, seemingly without regard to the cumulative impact.

The concern… is that industry may leave the state due to the high cost and considerable time needed to meet the regulations.

And from the Western States Petroleum Association:

Market-based approaches… outperform command and control measures from an environmental and economic perspective. If a state is going to pursue climate policy, market-based approaches can help balance the need to achieve greenhouse gas emission targets while reducing the economic impact on families, consumers, and the economy.

The takeaway from both: Climate regulations are cumbersome and confusing… so cumbersome that we might just have to take our business elsewhere. We want to be part of the solution, but on our own terms. Market-based approaches are better.

So what about CCS and CCUS?

Watch MIT Professor, Stanford alumnus, and former CEO of a Carbon Capture and Storage company Prof. Charles Harvey unpack the creative accounting behind the misleading claims of CCS’ largely oil-backed boosters in his recent Cornell University talk.

For those unable to watch the talk, its main takeaways are:

Governmental CCS support subsidizes both oil production and gas production

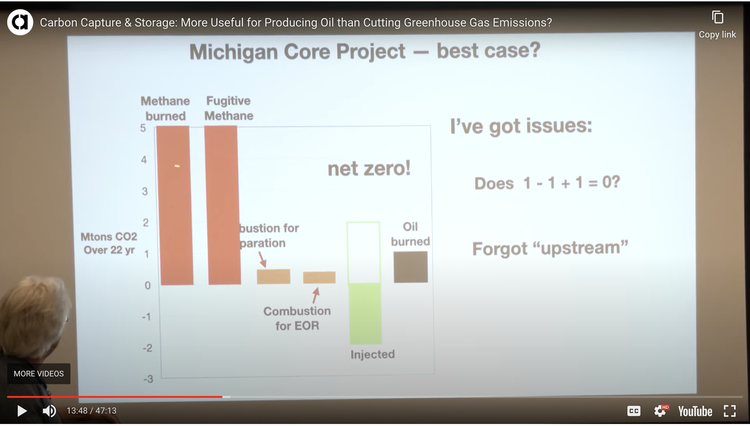

CCS accounting relies on sleight of hand, ignoring gas produced by gas processing plants. At an absolute best, this is equivalent to saying that 1 - 1 + 1 = 0. Most CCS plants are worse.

CCS capacity forecasts have consistently and massively over-estimated growth

Almost all of the academic studies assessing CCS are funded by oil and gas companies, directly or indirectly

Some more context:

CCS captures CO2 from point-sources like a power plants, meaning that CCS requires continued CO2 emissions in order to work. It can’t “clean up our mess” after the fact like other carbon removal strategies.

The “U” in CCUS stands for “utilization” and is almost always a euphemism for enhanced oil recovery — using the CO2 to pump out more oil.

In the vast majority of the world, including in California, renewables are cheaper than gas and coal, and demand-side measures are often cheaper than supply. Thus, shutting down existing gas and coal plants and replacing them with renewables and/or storage and demand-side measures is cheaper than retrofitting them with CCS, which increases operating costs and only pulls a portion (potentially < 30%) of the emitted CO2 from the air.

While renewables have been on an exponential tear, vastly outperforming projections, CCS deployment has been remarkablyslow, well short of projections, despite billions in government subsidies. In 2010, when global CCS installed capacity accounted for~0.04% of global CO2 emissions and global solar power eliminated~0.03% of global CO2 emissions, the International Energy Agency forecast that in 2022 CCS would account for ~2% of global CO2 emissions — a 50-fold increase — and that solar power would eliminate~0.1% of global CO2 emissions — a 3.3 fold increase. The reality? In 2022, CCS installed capacity has only increased by 3-fold from 2010 while total energy produced from solar has surged 40-fold and shows no signs of slowing. The IEA got the forecast backwards.

The common metric used for CCS, “installed capacity,” is the theoretical maximum that a plant could capture and is almost always greater than the amount actually abated.

Everything we’ve said up until now are taking CCS proponents’ claims at face value. CCS’ claims of carbon-neutrality or negativity use accounting that have been debunked by CCS industry veterans.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Insight

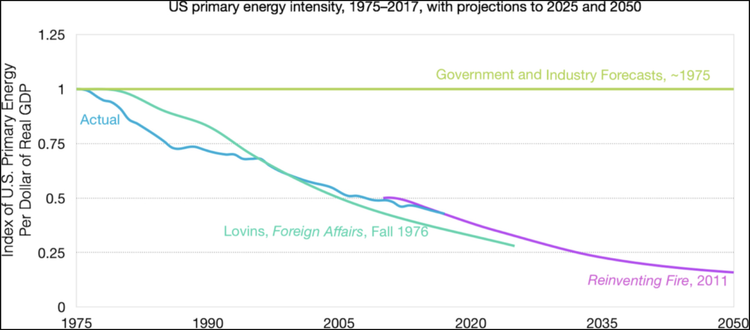

RMI and its founder, Amory Lovins, have a solid track record of predicting energy transitions and what will drive them (for instance, see the comparison figure below).

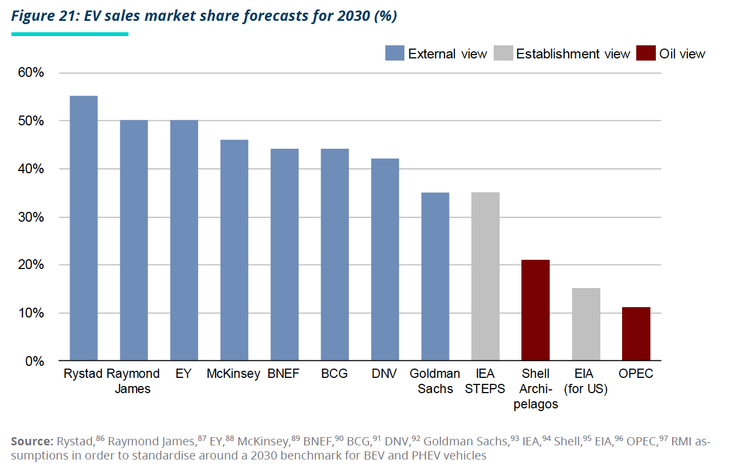

In a recent analysis of the the global transition to EVs, RMI addresses why so many other forecasts (split into three categories) continue to be so far off. Below are selected observations. We encourage those interested to read the entire report.

“The oil view. The desire of the fossil fuel sector for slow change, given form in an Excel spread-sheet. While we can and should largely dismiss these forecasts, they are given far too much credence by many people. It is reasonable to be skeptical about oil sector forecasts for EV sales.

Establishment view. The view of incumbent organisations such as the IEA or the EIA. These forecasts can be dragged down by the inherent conservatism of organisations seeking to pull together the views of oil producers and users.

External expert view. The view of external experts such as BNEF or the investment banks. These are superior, but as we show below they have also been forced to upgrade in light of the facts.

They provide detail on each category. Below is what they have to say about oil company forecasts:

5.2.2 The oil view

Some oil companies profess great theoretical enthusiasm for EV but then provide a long litany of concerns that, regrettably, will hold back growth. They worry about mineral availability, price, the Global South, charging infrastructure, and so on. And by worrying, they manage to persuade themselves that EV will not grow very fast. Which is very reassuring, because their business model is dependent upon their ability to hold back the growth of EV for as long as possible.

Some organisations are deeply linked to their high-paying clients in the oil sector, and we leave to the reader to judge whether those close relationships imperil the ability of these organisations to think objectively about change. [Bolding added]

Comparison of other forecasts of global EV market share in 2030. X-Change: Cars, by Kingsmill Bond, et al., published by RMI, Inc., 2023. We might note that today’s global battery electric vehicle market share (excluding plug-in hybrids) stands at 10%.

This is a good time to remember that our research at Stanford is only as good as our track record and our credibility. As a university, do we really want to risk producing distorted research and having our work dismissed as biased? It’s time to cut fossil fuel ties.